Advantages of Shipping from NI to GB

or GB to ROI/EU via NI under the NI Protocol

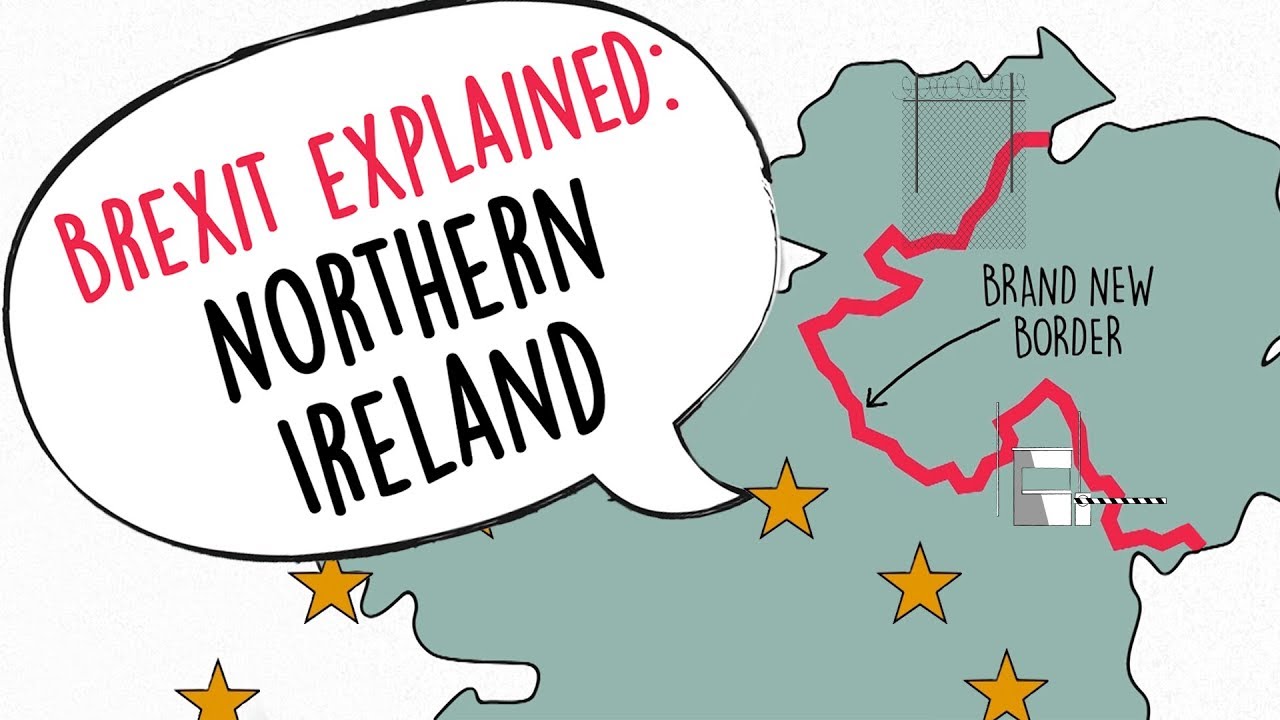

The UK-EU Trade and Cooperation Agreement (TCA) and the Northern Ireland Protocol came into effect on 1 January 2021. The Protocol provides that Northern Ireland will:

Remain aligned to a number of EU rules, namely:

- The Union’s Customs Code (UCC)

- EU rules on VAT in respect of goods

- EU rules on product standards and sanitary and phyto-sanitary rules (SPS); and

- EU state aid rules

Remain part of the UK’s customs territory and will apply EU duties on the movement of any goods that are deemed to be “at risk” of onward movement into the EU.

NI-GB

Firms in Northern Ireland will continue to have unfettered access to Great Britain, with no export or exit summary declarations, with limited exceptions, for products, whilst goods moving from GB to NI will remain tariff free, with a trusted trader scheme to be established. It can be advantageous for ROI/EU firms to use Tricord (who are a NI fulfilment firm) to ship individual packages to GB on their behalf. No additional forms are required although VAT will have to be charged and accounted for. No customs declarations are required to be placed on packages.

GB-NI-ROI/EU

It may no longer be economic for firms in GB to ship small individual packages to customers in NI or ROI.

A solution is to ship goods in bulk to Tricord and pay any necessary customs and freight charges. Tricord can then ship the relevant individual packages to businesses/consumers in NI, ROI or elsewhere within the EU in an economic manner – with lower carriage charges.

As Northern Ireland is still pert of the EU single market for goods no customs declarations are required to be placed on packages.

You will still be responsible for the proper treatment of VAT (from a charging and reporting perspective), but this will be less onerous than shipping directly from GB to EU countries.

Goods being shipped from NI to ROI/EU will have to comply with EU Distance Selling regulations, which changed on 1 July 2021. From 1st July 2021, the distance selling thresholds will be abolished and replaced by a single, pan-EU exemption threshold set at EUR10,000. Additionally, to free up online businesses from the burden of registering for VAT in multiple countries under the new rules, the MOSS (Mini One Stop Shop) scheme will be extended into an OSS (One Stop Shop) scheme. This will allow businesses to account and pay for the VAT due on their intra-EU distance sales and supplies of other B2C services in a single quarterly electronic VAT return. Hopefully you are now considering the advantages of shipping via Northern Ireland. Check out Tricord’s offerings for Direct Mail and our e-Commerce and Fulfilment Services.